Real life scenario

Recently Super I.T. Solutions was called out to a business to address a potential computer scam.

Our customer was presented with a website that was flashing a screen advising that her computer had been infected. Concerned that this was the case, our customer called the number on the screen to try to rectify this.

The computer was then remotely accessed by the recipient of the call and during this call, our customer was asked for her credit card details. The justification for this was that they would then repair the computer for her, over the phone.

Fortunately for our customer, as soon as she had this request, she terminated the call and contacted us. Her credit card details were not provided.

Our SuperTech Chris checked her system and advised what had happened. He discussed what was exposed to the caller, and after a thorough check, was deemed safe.

Computer hackers are playing these scenarios out daily, across thousands of websites and networks.

If you are ever confronted with a screen popping up and flashing that your phone or computer system has been infected, do not call a contact number, and do not click a link presented. Close the tab you are on and move on.

This could have been a bad case scenario for our customer, however, our customer felt something was up and did not proceed, and this is what saved her from having a very bad day.

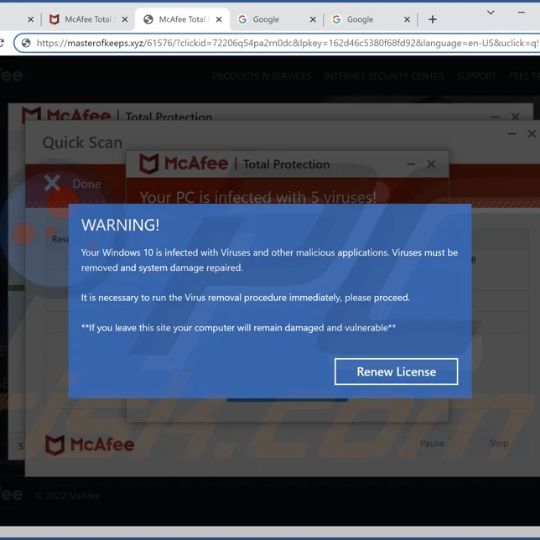

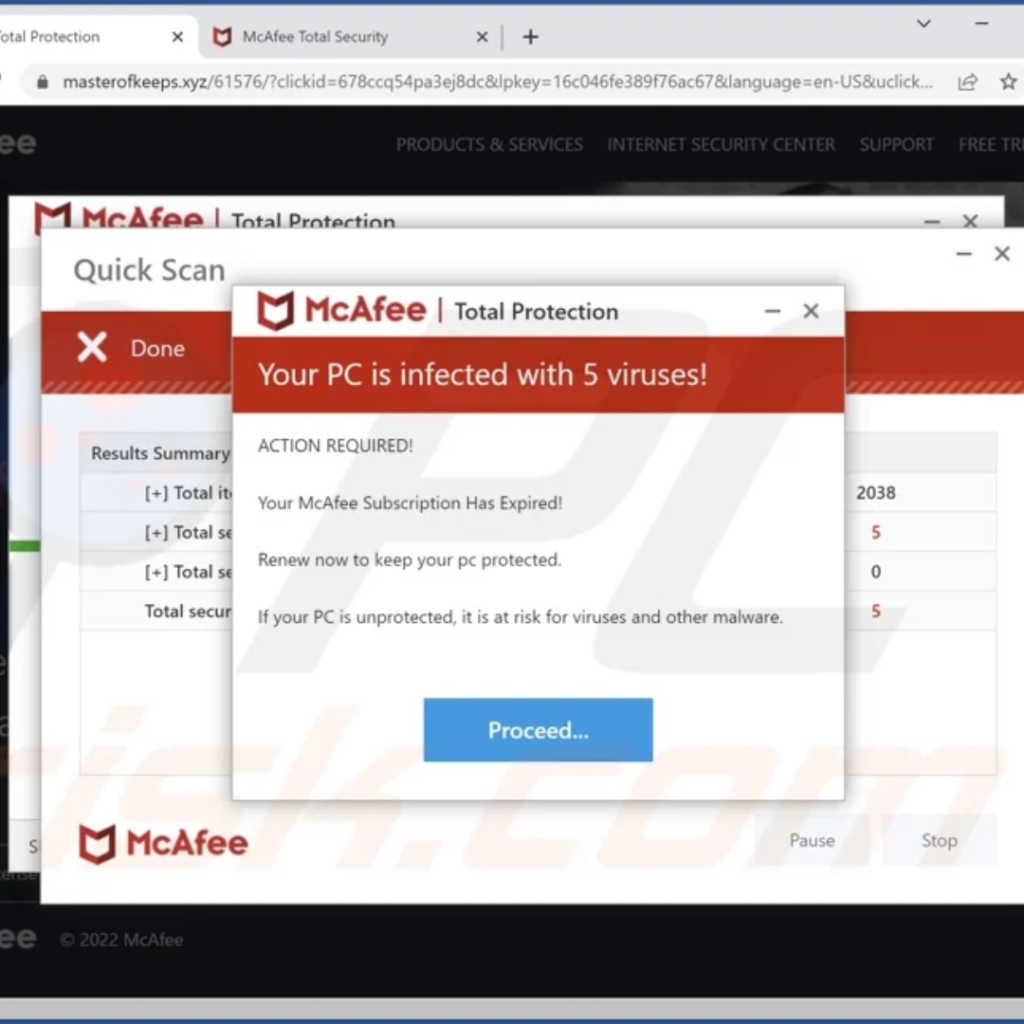

Windows 10 pop-up scam

The Windows 10 pop-up scam has been recently circulating (and has now moved onto Windows 11). A pop-up claims that the user’s computer has been infected and action needs to be made immediately to resolve it.

These scams are aggressive and can cause a user to panic and click the button that has been presented or contact a number displayed. These tactics are exactly how cybercriminals are getting away with tens of millions of dollars each year.

In addition to money, cybercriminals can use your personal details to bilk you out of other monetary areas such as online shopping accounts, or identity theft.

Although these scams use the logos and branding of genuine companies such as Microsoft, they are not in any way, related to Microsoft or any other corporation displayed on the message.

Windows aren’t the only ones being targeted. Popular anti-virus platform, McAfee is also a target.

How do these scams work?

You may be wondering how you have managed to access a site that has caused this notification because you would never visit an odd site, nor do you use torrent websites to illegally download audio and video files.

However, it is important to note that by using a variety of advertising networks, cybercriminals can generate traffic to their fake sites and even mask legitimate sites that you then clock on via a simple google search.

It might sound confronting, but by checking a few simple things, you can avoid being on a fake website at all.

How do I remove fake pop-ups?

Generally, these pop-ups have in no way infected your device. The pop-up is designed for you to take further steps, this opens the door for the cybercriminal to access your computer or mobile device. Closing the site down is sufficient in avoiding this moving further, however, sometimes the pop-up can render you unable to close the site, in which you would need to close your whole browser window and then reboot your device.

Less likely, you may need to reset your internet browser once you have restarted your device. If you do not know how just give your IT professional a call.

How do I prevent pop-up scams?

Streaming services such as YouTube, Torrent, or other platforms can redirect you to illegitimate sites. Therefore, as covered in a previous article, preventing cybercriminals’ access to your details is simple.

Only visit sites that are reputable or known to you. Never use a link click option that has been provided for you, type the URL in yourself. Check for grammatical and spelling errors. Check the URL, often they are misspelled or unrelated to the site content. Also, keep your internet browsers up to date and make sure your legitimate anti-virus protection is up to date.

What should you do if you fall for a pop-up scam?

Depending on which scam you fell for, your call to action may differ.

- If you sent money to cybercriminals: Contact your financial institution immediately and explain the situation. The bank will then take steps to secure your accounts and investigate. In most cases, you can get your money back.

- If you provided your personal information: Change your passwords immediately and enable multi-factor authentication on all online platforms you use.

- If you let cybercriminals access to your device: Use a reputable anti-virus such as SentinelOne to prevent this type of access, and contact your IT professional to go over your devices and network to diagnose any ongoing issues and clean them out.

- Report it: report internet scams to ScamWatch

Like this article? Follow us on Facebook for more info, tips and tricks!